Global tackle trade could be worth $23 billion by 2032

The fishing tackle industry is set to expand significantly over the next eight years, with growth possible of more than 50 per cent in that time.

According to US-based analysts Adroit Market Research, which valued the industry at $14.5 billion in 2022, our trade is expected to reach $23 billion by 2032, growing at a 4.8 per cent CAGR (compound annual growth rate) since last year to then.

Its latest report highlights the increased appeal of recreational fishing, higher disposable incomes, and a greater understanding of the advantages of engaging in outdoor pursuits.

While anticipated growth in sustainable fishing methodologies and the upsurge in fishing-related tourism are poised to propel substantial market expansion in the foreseeable future.

The global tackle sector is seen as playing a pivotal role in the economy and fostering environmental preservation through conscientious fishing practices.

The report drew on a range of tackle business profiles, including Pure fishing, Shimano, Daiwa, Gamakatsu, Johnson Outdoors, Pradco, Jarvis Walker and Tica and highlighted these and others such as Rapala VMC, Okuma and AFTCO as key players.

It said the Asia Pacific region is anticipated to continue having significant influence over the global trade, thanks to its manufacturing centres, most notably in China and Japan, expansive coastline and rich fish reserves, not to mention the rising trend of recreational fishing and the enhanced purchasing power of consumers in nations such as India and Australia.

Meanwhile, North America accounted for the highest market share dominance, especially when fishing excursions, equipment, permits and stamps, property ownership and leases, and membership donations are added unto the equation.

Rods are forecast to witness the highest demand, thanks to their diverse range of sizes, uses and the materials they are manufactured from.

Adroit also claims that saltwater fishing will assert its dominance in the industry, due to its heightened popularity and the ubiquitous nature of saltwater fishing in comparison to freshwater or fly fishing pursuits.

Forecasts also suggest that the online distribution channel will continue to emerge as the principal player in the market.

The report said: “The increasing prevalence of e-commerce platforms and their associated conveniences have prompted a growing number of consumers to opt for online fishing equipment purchases.

“Online retail avenues offer an extensive array of products, often at competitive price points, coupled with the added benefit of doorstep delivery.

“Additionally, these platforms typically feature comprehensive product details and user reviews, empowering consumers to make well-informed purchase decisions.

“These factors collectively underscore the ascendance of the online distribution channel as the predominant force in the fishing equipment market landscape.”

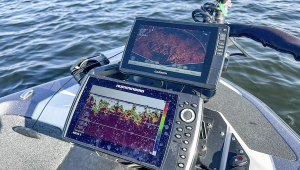

Other key factors cited in the report which will encourage future growth are thew rise in technology usage within the sector – making the sport easier and more accessible to some – not to mention the efforts of many groups, organisations and governing bodies to encourage more women, children and ethnic groups to pick up a fishing rod.

- Log in or register to post comments